Understanding Nonprofit Financial Statements for Boards

Your board is the glue that holds your nonprofit together. Composed of members passionate about your cause, your board provides the strategic direction and governance your organization needs to continue pursuing its mission.

One of the most important aspects of the job is financial management. Board members must work alongside your leadership team, finance committee, and accounting staff to keep your organization financially healthy.

Doing so requires board members to understand your nonprofit’s current financial standing, which starts with interpreting financial statements. We’ll start with the board’s role in the overall nonprofit financial management process and then cover the basics of nonprofit financial statements.

Role of Board Members in Nonprofit Financial Management

As a board member, you help your organization comply with financial regulations and steward funds responsibly by:

- Creating financial policies. The financial policies, procedures, and controls your board instates govern how your organization uses its funds. Typical nonprofit financial policies include gift acceptance, conflict of interest, and expense reimbursement policies. You may also include budgeting, financial reporting, cash management, and grant management guidelines.

- Approving the annual budget. Your board, leadership team, finance committee, and accounting staff each have a hand in the budgeting process; it’s the board’s responsibility to approve the final version, ensuring it aligns with your current overarching strategy.

- Monitoring financial performance. Throughout the year, board members assess how well your nonprofit sticks to the budget and analyze overall financial performance. They also track key performance indicators (KPIs), such as donor retention rate, program services ratio, and months of cash on hand, to evaluate your financial health.

- Helping with strategic planning. A strategic plan is a document that outlines your nonprofit’s priorities for the next several years. Your board plays a role here by creating financial goals, identifying financial priorities, and noting any relevant financial risks and opportunities.

Through these activities, the board provides financial oversight and applies members’ knowledge of your nonprofit’s priorities to its financial planning.

4 Main Nonprofit Financial Statements

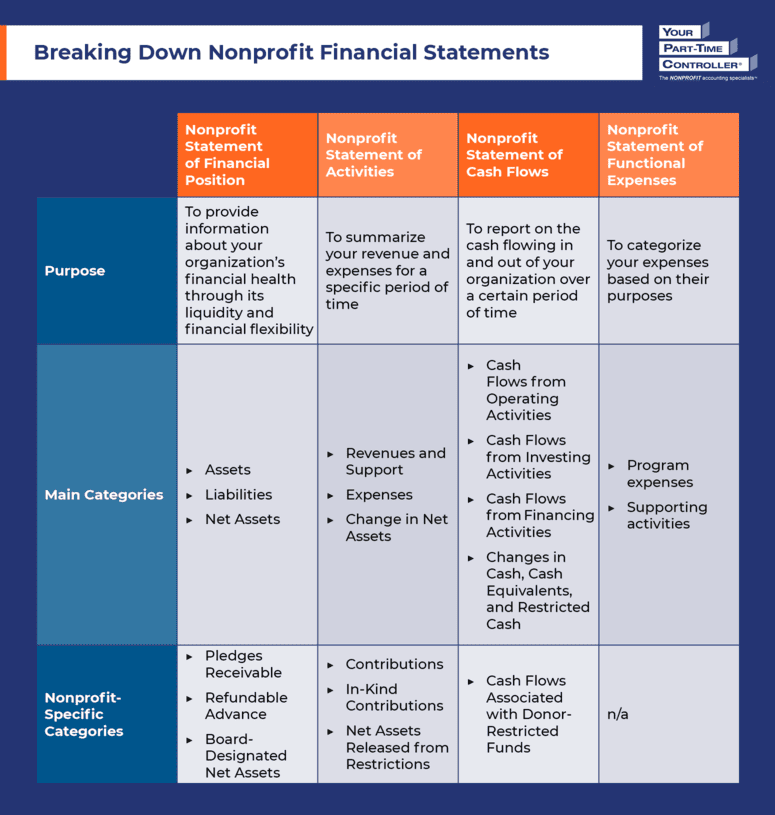

As YPTC explains, the four main types of nonprofit financial statements are:

- Statement of Financial Position

- Statement of Activities

- Statement of Cash Flows

- Statement of Functional Expenses

Let’s explore each of these documents and what board members should know about them.

Nonprofit Statement of Financial Position

The nonprofit Statement of Financial Position aims to convey your organization’s financial health through its assets and liabilities. This information allows you to assess your nonprofit’s liquidity and financial flexibility.

The three main categories of this statement are:

- Assets. Assets are resources your nonprofit owns or controls, which may be current or noncurrent. For example, current assets may include cash and cash equivalents, accounts receivable, prepaid expenses, and inventory. Noncurrent assets may include land, buildings, and equipment.

- Liabilities. You also have liabilities—financial debts or obligations. Current liabilities may include accounts payable, accrued expenses, and deferred revenue; noncurrent liabilities may include mortgages or long-term lease obligations.

- Net Assets. Calculate your net assets by subtracting liabilities from assets. The difference represents your organization’s current financial position, with positive assets indicating your nonprofit is in a healthy spot and negative assets prompting you to adjust your resource allocation.

This document also has some nonprofit-specific categories, one of which is directly related to board members. Board-designated net assets are unrestricted funds that your board sets aside for a specific purpose. For example, board members may earmark funds for a future program or investment.

Nonprofit Statement of Activities

The nonprofit Statement of Activities summarizes your revenue and expenses for a monthly, quarterly, or annual period. It demonstrates how well your organization manages its resources and allows you to share this information with internal and external stakeholders.

This document includes the following categories:

- Revenues and Support. Your nonprofit generates revenue and garners support from various sources. For instance, you may bring in funds from program fees, fundraising events, and rental income, which you would report under the Revenues and Support category.

- Expenses. Your organization also incurs expenses, which are costs associated with program, management and general, and fundraising activities.

- Change in Net Assets. To calculate your change in net assets, find the difference between your revenues and expenses. This figure shows how your financial resources have changed over the designated period.

The nonprofit-specific line items in this statement include contributions (monetary donations with or without donor restrictions), in-kind contributions (nonfinancial donations of goods or services), and net assets released from restrictions.

Nonprofit Statement of Cash Flows

Cash goes in and out of your organization on a regular basis. The nonprofit Statement of Cash Flows demonstrates how this cash moves through your nonprofit and whether it comes from investing, financing, or operating activities.

As such, this statement’s categories include:

- Cash Flows from Operating Activities. Cash inflows from operating activities include cash generated from donations, program fees, grants, and membership dues. Cash outflows from operating activities include cash used for staff salaries and wages, utilities, supplies, and rent.

- Cash Flows from Investing Activities. Any proceeds your organization receives from investment sales or maturities are cash inflows from investing activities. Cash outflows in this category include investments and property or equipment purchases.

- Cash Flows from Financing Activities. Your cash inflows from financing activities include lines of credit and loan proceeds, and your cash outflows from financing activities include payments of debts like your mortgage.

- Changes in Cash, Cash Equivalents, and Restricted Cash. Noting your cash, cash equivalents, and restricted cash at the beginning and end of the period allows you to evaluate changes in your cash flows over time.

You may also report on cash flows associated with donor-restricted funds to show which resources donors have designated for a specific purpose.

Nonprofit Statement of Functional Expenses

The IRS requires nonprofits to report on the nature and function of their expenses. While they can do so on the face of the Statement of Activities or as a schedule in the notes attached to the full set of documents, most choose to create a separate financial statement to keep this information organized: the nonprofit Statement of Functional Expenses.

The categories of this document include:

- Program expenses. Program expenses are costs directly related to your services. For example, a soup kitchen purchasing kitchen supplies would incur a program expense.

- Supporting activities. All other expenses fall under one of the three main types of supporting activities:

- Management and general expenses, which are general operating costs.

- Fundraising expenses, such as costs associated with soliciting donations and securing grant revenue.

- Membership development expenses, including costs related to new member solicitation, membership dues collection, and member stewardship.

You’ll list each expense by its natural classification, such as personnel costs, professional services, office expenses, occupancy, utilities, and depreciation. Ultimately, the total expenses on your Statement of Functional Expenses should match those on your Statement of Activities.

When you understand each of these financial reports and their intended purposes, you’ll be better equipped to fulfill the financial management aspect of your role. If you run into questions or obstacles, don’t be afraid to consult other team members, especially your accounting staff, who are responsible for compiling these statements.