Matching Gifts: Reap the Benefits for Your Nonprofit

Corporate philanthropy is a great opportunity for nonprofits seeking additional sources of revenue. In particular, matching gift programs are one of the best forms of employee giving your nonprofit can leverage. It’s estimated that $2-3 billion is donated annually through these initiatives, making them valuable options for nonprofits of all sizes.

To educate you further on how matching gift programs can benefit your organization, we’ll cover the following topics:

- What are matching gifts?

- The Impact of Matching Gifts

- Who benefits from matching gifts?

- Top 3 Benefits of Matching Gift Programs

- How to Raise Even More with Matching Gifts

- Sample Matching Gift Letters

Matching gifts are an opportunity for your nonprofit to boost your fundraising revenue significantly, which means your team will have more funds available for programs, events, and everything else you do to serve your beneficiaries. Let’s get started on the basics so you can begin tapping into this form of corporate giving!

What are matching gifts?

In a nutshell? A matching gift is a donation a company makes to match an employee’s initial donation to a nonprofit. So when an individual makes a gift of $50 to an organization, their employer will make an additional gift of $50, for a total of $100.

Now, that’s assuming the employer offers a 1:1 match ratio (a dollar for dollar match). A match ratio can range anywhere from .5:1 to 4:1.

So, let’s say that $50 was matched at a 2:1 ratio instead. That means that initial $50 donation turns into $150 ($50 from the donor plus $100 from their employer)!

Now that our math lesson is over, let’s talk about how matching gifts actually work.

The overall process is pretty simple and tends to be the same across the board:

- An individual donates to a nonprofit.

- The individual checks their eligibility for matching gifts with their employer.

- The individual submits a request for a match to their employer.

- The employer reviews the request and verifies the donation with the nonprofit.

- The employer matches the gift.

The thing is, most companies have unique policies and guidelines when it comes to eligible nonprofits and their employees submitting matching gift requests.

These can include:

- Minimum and maximum match amounts

- Match ratios

- Nonprofit eligibility

- Employee eligibility

Not being able to figure out their employer’s guidelines can turn donors away from the process altogether, which brings us to our next point.

The Impact of Matching Gifts

Matching gifts seem like a pretty good deal, don’t they? Turning one donation into two? Well, as we’ve already indicated, not every donor knows how to go through the process of submitting a match request. Remember that number we mentioned earlier? Billions of dollars in matching gift funds go unclaimed every year.

Far too many organizations and donors overlook matching gift programs because there are too many company guidelines to keep track of, and nonprofits can’t easily track the companies their donors work for. Likewise, donors don’t always know whether their companies even offer matching gift programs.

So, it’s simple: matching gifts get overlooked.

But there are more reasons to pursue matching gifts than not.

For example:

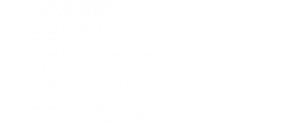

Did you know that 84% of donors say they’d be more likely to donate if a match was offered? That means if a donor is on the fence about giving to your nonprofit, notifying them that they might be eligible for a match through their company could be the extra push they need to make their donation.

But it doesn’t stop there.

In addition to the donors who would give if a match were applied, 1 in 3 donors say they’d give a larger amount if a match was available.

So not only would you get a donation in the first place, but the amount could be even bigger than it would have been otherwise!

We’ve talked a lot about company matching gift programs and how they can differ from each other. But a common theme is that many of these programs are pretty generous. To give you an idea of what your organization could be missing out on, here are some incredible matching gift programs:

The Coca-Cola Company matches donations made by full-time employees or retirees up to $10,000. As if that’s not enough, they offer a 2:1 match, which means the total maximum cap is $20,000!

Soros Fund Management matches donations made by full-time employees to most nonprofits at up to a 2:1 ratio, with a maximum cap of $100,000.

Merck & Co. matches donations made by active employees at a 1:1 ratio up to $30,000. Most nonprofits are eligible for these matching gifts.

This is just a taste of how generous a lot of these matching gift programs can be. Many companies’ maximum match amounts are in the thousands, and their minimum match amount can be as low as $25, if there’s even a minimum at all.

It should be pretty clear by now that there are a lot of benefits to tapping into matching gift programs. That’s why we’re going to dive deeper into those benefits next.

Who benefits from matching gifts?

As we get into the benefits of matching gift programs, we should also note that it’s not just nonprofits that can benefit from them.

In fact, matching gift programs benefit nonprofits, donors, and companies. Here’s how:

Benefits for Nonprofits

Let’s start with you. Matching gifts benefit many types of nonprofit organizations. While some companies are specific about what type of organization they’ll match donations to, a majority of 501(c)(3) organizations are usually eligible. And as a nonprofit, every donation dollar counts. Beyond just doubling donations, matching gifts offer nonprofits a way to build long-term relationships with companies and donors. The more support you have, the more you’ll be able to accomplish.

Benefits for Donors

Matching gifts benefit donors, too. When a donor gives to your organization and then successfully requests a match from their employer, they’re essentially doubling the impact of their gift. This gives donors a greater sense of pride knowing that their donation went twice as far.

Benefits for Companies

There are many benefits for companies, too. By taking part in corporate social responsibility (CSR) programs like matching gifts, companies maintain a positive public image, keeping their employees and consumers happy. In terms of tax benefits, companies can also deduct the amount they matched from the original donation.

In short, matching gift programs benefit everyone involved. Nonprofits get extra support, donors feel proud for making their contributions go even further, and companies look great for supporting nonprofits.

Top 3 Benefits of Matching Gift Programs

As a nonprofit specifically, there are even more benefits of matching gift programs you should be aware of. For that reason, we’ve compiled the top three perks you should keep in mind when deciding whether you want to pursue this type of corporate giving program:

1. A second donation for the cost of soliciting one.

The most obvious benefit? Matching gifts are cost-effective—you get a second donation for the cost of soliciting one. Basically, this means you’ll get more revenue from one donation without asking donors to reach back into their own pockets. You’ll also save the time you would’ve spent soliciting a separate donation from another donor. It’s a win-win!

2. A deepened relationship with supporters.

Beyond just the monetary aspect, matching gifts allow your nonprofit to develop a deepened relationship with supporters. Matching gifts can actually help with donor retention, which means the more you mention matching gifts and keep your donors in the loop, the higher your retention rate will be. Donors will also feel more engaged with your organization when they know they’re making a bigger impact with their gifts.

3. Increased fundraising revenue to put toward your programs.

When your organization actively pursues matching gifts, you can significantly increase your fundraising revenue. That means you’ll be able to put on more programs and events that benefit your constituents.

Matching gifts can also aid in prospect research and finding major gift donors. Imagine if a major donor was eligible for matching gifts through their company—that would be a huge boost for your nonprofit!

Just thinking about these top benefits of matching gifts should get your team excited. There’s so much untapped potential out there that you can explore.

How to Raise Even More with Matching Gifts

You might be thinking that making matching gifts part of your fundraising strategy is easier said than done.

But there are ways you can benefit from matching gifts without requiring too much extra effort from your team.

We’ve written about promoting matching gifts before, and one of the best ways you can leverage matching gift programs is to meet donors at the point where they’re most engaged: the donation process.

Once a supporter lands on your donation page, that means they’re serious about donating to your cause. Remember how donors are more likely to give if a match is applied? That means if you actively promote matching gifts during your donation process, your donor will be more likely to give and check out the matching gift opportunity.

So, what’s the best way to promote matching gifts during the donation process?

In a nutshell: make it easy for the donor to find out about their company’s matching gift program.

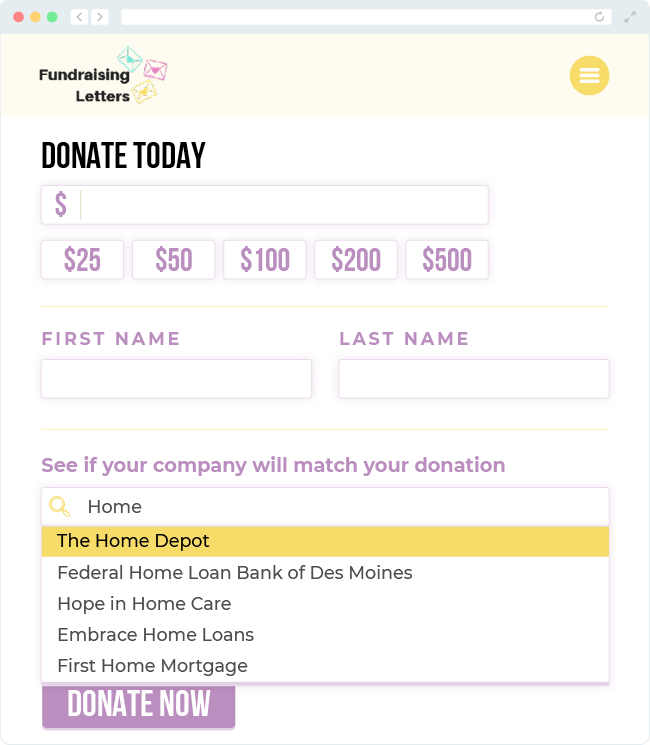

Investing in a matching gift search tool, for example, is a great way to do this. All you have to do is embed the tool into your donation page (or anywhere on your site, really!), and donors can type in the name of their employer. If that employer offers a matching gift program, all of the info about their program (match ratios, eligibility, etc.) will pull up right away.

Here’s what that kind of search tool looks like:

The great thing about matching gift search tools like the above is that they can be customized to match your organization’s branding. And when the tool is embedded directly into your donation process, more donors will see the matching gift opportunity and search for their employer.

Don’t have your donors’ employment information? Some matching gift tools even come with real-time employer appends, meaning the tool will find and add that data for you instantly.

If you want to take this process several steps further, you can invest in a matching gift automation platform. An automation platform takes the info donors provide as they give to your nonprofit (such as email domain or employer name) and runs it against a database of thousands of matching gift programs. If it turns out your donor works for a matching gift company, the platform will automatically send out a customizable email to that donor that explains how they can submit a match request.

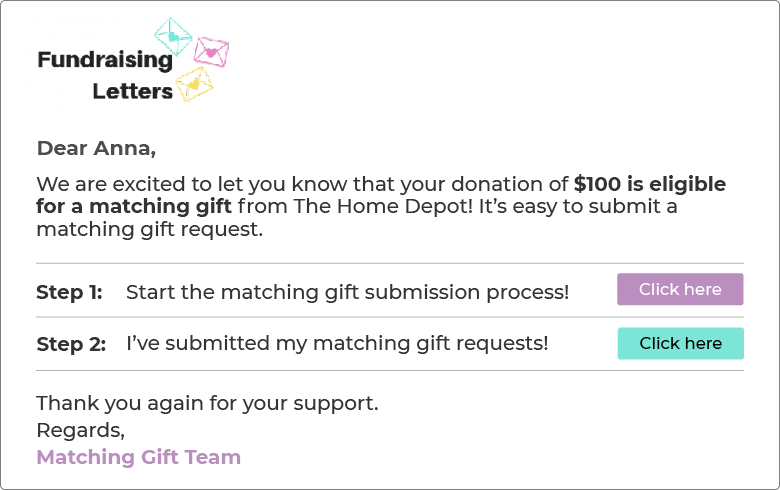

Here’s what that email could look like:

Notice how the email identifies the donor’s employer and offers actionable steps to complete the matching gift process. A customizable experience will make the donor even more likely to be responsive.

When you drop matching gift solutions like these into the mix, you have a chance to skyrocket your matching gift revenue. If you really want to benefit from matching gifts, consider adding these to your team’s toolkit.

Sample Matching Gift Letters

If you’re looking for some guidance as you start to reach out about matching gifts, here are some basic matching gift letters you can use to tell donors about the opportunity. You probably already send out thank-you emails once a donor has contributed to your cause. Why not include these templates, too?

Sample Matching Gift Letter for Small Nonprofits:

Dear [donor’s name],

[nonprofit’s name] could not do what we do without you. Our mission needs all the support and help we can get, and your donation of [donation amount] has brought us further than we ever have been before. We are so close to our goal of [fundraising goal] and making [your mission] happen.

There’s a good chance your employer offers a matching gift program to help double your impact. The process is simple, and we would love to do most of the work for you. In a few simple steps, you can increase your donation and continue to change lives:

Step 1: Contact your employer’s HR head to see if they offer a matching gift program to increase your donation.

Step 2: Your HR head will point you in the right direction and let you know if you need to fill out any necessary forms and be aware of submission deadlines.

Step 3: Once you have submitted your matching gift request form or if you have any questions about the process, please contact us at our website [website URL] or phone number [phone number].

Additionally, if your company doesn’t offer a matching gift program or won’t match your donation, please let us know as well.

[nonprofit’s name] appreciates each donation and act of support you make.

Thank you,

[nonprofit’s name]

Sample Matching Gift Letter for Large Nonprofits:

Dear [donor’s name],

Here at [nonprofit name], we appreciate every gift we receive. Your donation of [donation amount] has made such an impact to [your mission] and has done [a recent accomplishment] for us.

We are so close to our donation goal of [fundraising goal] and we think you can help get us there. Your contribution has already done so much, but we believe your employer, [donor’s workplace], may have a matching gift program that will match your generous donation and double your impact!

Taking the steps to increase your gift is a simple process. Please see the instructions below:

Step 1: Contact your employer’s HR head to see if they offer a matching gift program to increase your donation.

Step 2: Your HR head will point you in the right direction and let you know if you need to fill out any necessary forms and be aware of submission deadlines.

Step 3: Once you have submitted your matching gift request form or if you have any questions about the process, please contact us at our website [website URL] or phone number [phone number].

Additionally, if your company doesn’t offer a matching gift program or won’t match your donation, please let us know as well.

We appreciate your support tremendously. You are the reason we are able to reach our goal of [fundraising goal] and achieve [your mission.]

Thank you,

[nonprofit’s name]

Use templates like these to guide you as you set out to find matching gift revenue for your organization. Then, if you ultimately decide to invest in matching gift solutions, you’ll already have a great foundation for communicating with your donors!

Additional matching gift resources…

Now you know how to incorporate matching gifts into your nonprofit’s fundraising strategy, you’re ready to start raising more funds to power your purpose. Keep in mind that the largest obstacle to a successful matching gift program is awareness—after all, an estimated $4-7 billion in matching gift funds goes unclaimed per year. Be sure to properly educate your supporters about this opportunity!

If you’d like to learn more about matching gifts, check out the following resources:

- Sample Matching Gift Letter Templates. Looking for even more matching gift letter templates? Check out our library to craft your outreach!

- How to Promote Matching Gifts (and Other Best Practices!). There are many ways to effectively promote matching gifts. We’ve compiled some of the best strategies here.

- Top 30 Matching Gift Companies: Find Your Match. Looking for some of the top matching gift companies? Here’s a comprehensive list from 360MatchPro by Double the Donation.