The scarcest resource for any nonprofit organization isn’t always funding; often, it is time. Specifically, it is the time of dedicated volunteers during standard business hours. You likely have a roster of passionate supporters willing to help on weekends, but finding someone to staff a registration desk at 2:00 PM on a Tuesday or help with a school field trip on a Friday morning can feel impossible.

The barrier is obvious: the 9-to-5 workday. However, a growing trend in corporate philanthropy is breaking down this wall. Paid Volunteer Time Off (VTO) is an employee benefit that allows individuals to volunteer during work hours without losing pay. It is a massive opportunity for nonprofits to secure highly skilled, energetic volunteers when they are needed most.

In this comprehensive guide, we will provide the strategies, best practices, and copy-and-paste templates you need to mobilize your corporate supporters:

- What Is Volunteer Time Off (VTO)?

- Why Volunteer Time Off Letters Are Critical for Nonprofits

- The Strategic Timing of VTO-Related Outreach

- Template 1: For Volunteers With Known VTO Benefits

- Template 2: For Volunteers With Unknown Eligibility

- Template 3: Advocacy Tools for Ineligible Volunteers

- Maximizing Impact: The “Double Dip” Strategy

- Best Practices for Writing Effective VTO Letters

The catch? Many of your supporters don’t even know they have this benefit. To unlock this resource, you need a proactive communication strategy. By incorporating volunteer time off letters into your donor and volunteer outreach, you can educate your community, remove the barrier of “work commitments,” and fill your volunteer shifts with ease.

What Is Volunteer Time Off (VTO)?

Before writing your letters, it is crucial to understand the mechanism behind the ask. Paid volunteer time off is a type of employee benefit in which team members receive a number of hours designated for volunteerism above and beyond existing PTO (Paid Time Off).

Essentially, companies pay their employees to show up for your nonprofit.

While vacation days are for rest and sick days are for health, VTO is specifically for community engagement. The structure of these programs varies by company, but they generally fall into a few categories:

- Individual VTO: Employees are given a bank of hours (e.g., 8 to 40 hours annually) to volunteer with a nonprofit of their choice.

- Group Volunteer Events: Companies organize team-building days where departments take time off together to complete a service project.

- Skills-Based Volunteerism: Employees use their professional expertise (marketing, IT, finance) to assist a nonprofit during work hours.

Did You Know? The number of companies offering VTO has increased by 2 in 3 over the last decade. Currently, 66% of employers provide some sort of paid time off program for volunteering. Despite this growth, awareness remains low. By sending volunteer time off letters, you are helping your supporters utilize a benefit that is otherwise going to waste.

Why Volunteer Time Off Letters Are Critical for Nonprofits

You might assume that if a donor wants to volunteer, they will find a way. However, statistics show that logistical hurdles are the primary reason people do not volunteer. In fact, 49% of individuals state that work commitments are their biggest obstacle to volunteering.

By sending a letter specifically addressing VTO, you are directly removing that obstacle. You are telling your supporters: “You don’t have to choose between your job and your passion for our cause. You can do both.”

Furthermore, engaging corporate employees through VTO often leads to deeper financial support. 79% of people who volunteer also donate to the organization. When you bring a corporate volunteer through your doors using VTO, you are not just getting a pair of hands for the afternoon; you are cultivating a relationship with a donor who is statistically more likely to support you financially.

The Strategic Timing of VTO-Related Outreach

To get the highest conversion rate on your volunteer time off letters, you need to send them when your needs are high and when employees are most likely to be thinking about their benefits.

1. The “New Year” Refresh (January)

Most corporate benefit years reset on January 1st. Employees have a fresh bank of VTO hours (often an average of 20 hours per year ) and are looking for ways to fulfill New Year’s resolutions regarding community service. Sending a letter in January plants the seed for the rest of the year.

2. Pre-Event Recruitment

If you have a major event coming up—like a charity golf tournament, a gala setup, or a community clean-up day—that requires daytime help, send a targeted VTO letter 6-8 weeks in advance. This gives employees enough time to request the day off and get manager approval.

3. Volunteer Appreciation Week

Use Volunteer Appreciation Week not just to say thank you, but to educate. Remind your existing volunteers that they might be able to volunteer more without sacrificing their weekends by utilizing their company’s VTO policy.

4. Back-to-School Season (August/September)

For education-focused nonprofits or PTAs, the start of the school year is prime time. Parents are looking for ways to be involved, and knowing they can use VTO to chaperone a field trip or help in the library can be a game-changer.

Template 1: For Volunteers With Known VTO Benefits

If you are using a corporate giving database or have collected employer data during your volunteer registration process, you can segment your list. This template is for supporters whom you know work for companies with VTO programs (like Salesforce, Deloitte, or Patagonia).

Subject: [Volunteer Name], did you know [Company Name] pays you to volunteer?

Dear [Volunteer Name],

Thank you for being such a dedicated supporter of [Nonprofit Name]. Your commitment helps us [Brief Mission Statement, e.g., provide shelter to animals in need].

We know how busy life can be, and balancing work with volunteering isn’t always easy. That is why I wanted to highlight a fantastic benefit offered by your employer, [Company Name].

Our records show that [Company Name] offers a paid Volunteer Time Off (VTO) program. This means you can take time off work to volunteer with us—without using your vacation days or losing pay!

How to Use Your VTO to Support [Nonprofit Name]:

- Check Your Balance: Log into your employee benefits portal to see how many VTO hours you have available this year.

- Pick a Shift: Visit our volunteer calendar [Link] to find a daytime opportunity that fits your schedule.

- Request the Time: Submit the time off request to your manager using your VTO code.

We currently have a high need for volunteers on [Day of Week] mornings to help with [Specific Task]. Using your VTO for just one shift would make a massive difference for our team.

Thank you for everything you do!

Sincerely,

[Your Name] [Your Title]

Quick Tip: Mentioning specific companies adds credibility. For example, knowing that Thomson Reuters offers two paid days (16 hours) each year allows you to be specific in your ask: “You could spend two full days with us this year without missing a paycheck!”.

Template 2: For Volunteers With Unknown Eligibility

For the majority of your database, you may not know where they work or what benefits they have. This letter serves as an educational tool, prompting them to investigate their own benefits package.

Subject: A secret way to volunteer without working weekends…

Dear [Volunteer Name],

We know that between work, family, and personal time, finding hours to volunteer can be a challenge. That’s why we want to make sure you aren’t missing out on a benefit you might already have.

Did you know that 66% of employers offer paid Volunteer Time Off (VTO)?

VTO allows employees to volunteer during regular business hours while still getting paid. It’s a way for companies to support the causes their employees care about—like [Nonprofit Name]!

Could you be eligible?

It takes just a few minutes to find out:

- Check your employee handbook or HR portal.

- Search for keywords like “Volunteer Time Off,” “Community Service Leave,” or “Paid Release Time.”

- Ask your HR representative if the company supports paid volunteering.

If you have VTO hours available, we would love to see you during the week!

Daytime volunteers are crucial for our operations, helping us [Specific Impact, e.g., sort food donations] when our staff is stretched thin.

[Link: Check Our Weekday Volunteer Schedule Here]

Thank you for being a vital part of our community.

Best regards,

[Your Name] [Title]

Template 3: Advocacy Tools for Ineligible Volunteers

What if a volunteer checks their handbook and finds… nothing? This isn’t a dead end; it’s an opportunity. Employees have significant influence. By providing them with a template to send to their HR department, you empower them to advocate for a VTO program. This helps them, and potentially hundreds of their colleagues, volunteer with you in the future.

Subject: No VTO? Here is how to ask for it.

Dear [Volunteer Name],

Thank you for checking your eligibility for Volunteer Time Off! Even if your company doesn’t offer a program yet, you can help pave the way for future support.

Corporate social responsibility is growing fast; the number of companies offering VTO has increased by 2 in 3 over the last decade. Many companies start these programs simply because employees ask for them.

If you feel comfortable, consider sending the note below to your HR director or Community Relations manager to express your interest.

Subject: Inquiry regarding Volunteer Time Off (VTO) policies

Message:

Hi [HR Contact Name],

I recently spent time volunteering with [Nonprofit Name], a cause I care deeply about. I learned that many companies in our industry offer “Volunteer Time Off” (VTO) programs, which allow employees to dedicate a few hours annually to community service during the workday.

Does our company currently offer anything like this?

Research shows that offering VTO helps attract talent and boosts employee engagement. In fact, 62% of individuals report that the ability to volunteer during business hours is a top factor for a positive volunteer experience.

I would love to chat about how we might be able to implement a pilot program or a “Day of Service” here. It seems like a fantastic way to support our team and give back to our local community.

Thanks,

[Employee Name]

Thank you for being an advocate for [Nonprofit Name]!

Sincerely,

[Your Name]

Maximizing Impact: The “Double Dip” Strategy

Sending volunteer time off letters opens the door to a powerful fundraising idea: the “Double Dip.”

Many companies that offer VTO also offer Volunteer Grants. This means the company pays the employee to volunteer (VTO) AND writes a check to the nonprofit based on the hours served (Volunteer Grant).

For example, Microsoft offers a volunteer grant of $25 per hour. If an employee uses 8 hours of VTO to help your nonprofit, you receive 8 hours of free skilled labor plus a $200 donation from Microsoft.

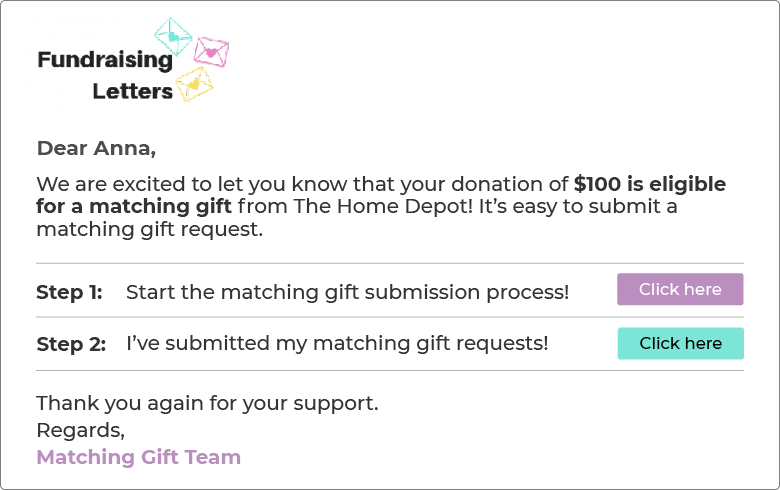

How to include this in your letters: Add a P.S. to your templates: “P.S. Does your company also offer Volunteer Grants? After you finish your shift, you might be able to log your hours and earn a monetary grant for [Nonprofit Name]—doubling your impact!”

Best Practices for Writing Effective VTO Letters

To ensure your letters get opened and acted upon, follow these best practices derived from successful corporate engagement strategies.

1. Focus on the Benefit to the Donor

While VTO helps you, frame it as a benefit to the volunteer. Use phrases like “Use your benefits,” “Take a break from the office,” or “Volunteer without sacrificing your weekend.” Remind them that 96% of employees who participate in corporate volunteerism report having a positive company culture—it’s good for their well-being.

2. Be Specific About Needs

Don’t just ask them to “volunteer.” Be specific about why you need daytime help.

- Weak: “We need help during the day.”

- Strong: “We need three volunteers next Tuesday from 10 AM to 2 PM to help distribute lunches. Using 4 hours of VTO would ensure these families get fed.”

3. Simplify the Process

If you have a database of companies, provide the specific steps for that employer. For example, if you are emailing a GM Financial employee, mention that they have 8 hours of VTO per quarter available. The more specific you are, the less research the donor has to do.

4. Create a Dedicated Web Page

Include a link in your letter to a “Corporate Volunteering” page on your website. This page should list companies with known VTO programs, instructions for signing up, and your Tax ID number (often needed for logging hours). This establishes a centralized hub for relevant resources.

5. Leverage Social Proof

In your newsletters, highlight a volunteer who used VTO. “Meet Sarah! She used her VTO day from [Company] to help us plant our community garden. Thanks to her employer, she didn’t lose a cent of pay, and we gained a beautiful garden.” This normalizes the behavior and encourages others to check their own benefits.

Wrapping Up & Next Steps

Volunteer Time Off letters are a low-cost, high-reward tool in your fundraising arsenal. By educating your supporters about the benefits sitting in their employee handbooks, you can unlock a new wave of daytime volunteers and deepen your relationships with corporate partners.

Remember, the goal is to make it easy for supporters to say “yes.” By providing templates, doing the research for them, and highlighting the double impact of their time, you turn a logistical challenge into a strategic advantage.

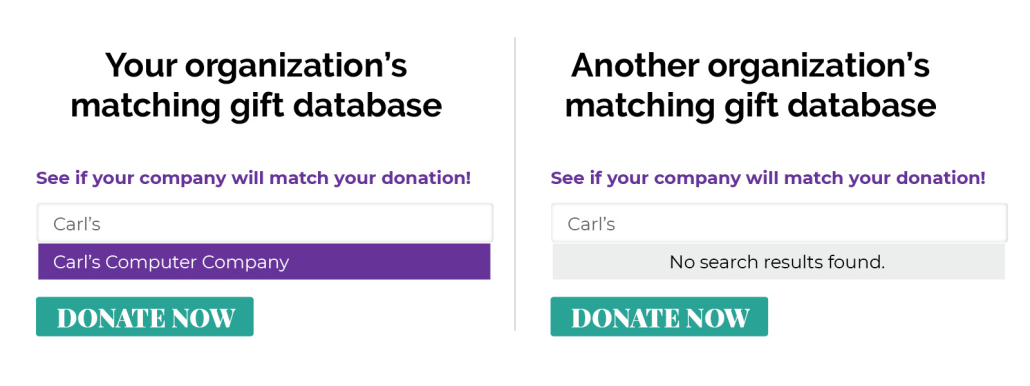

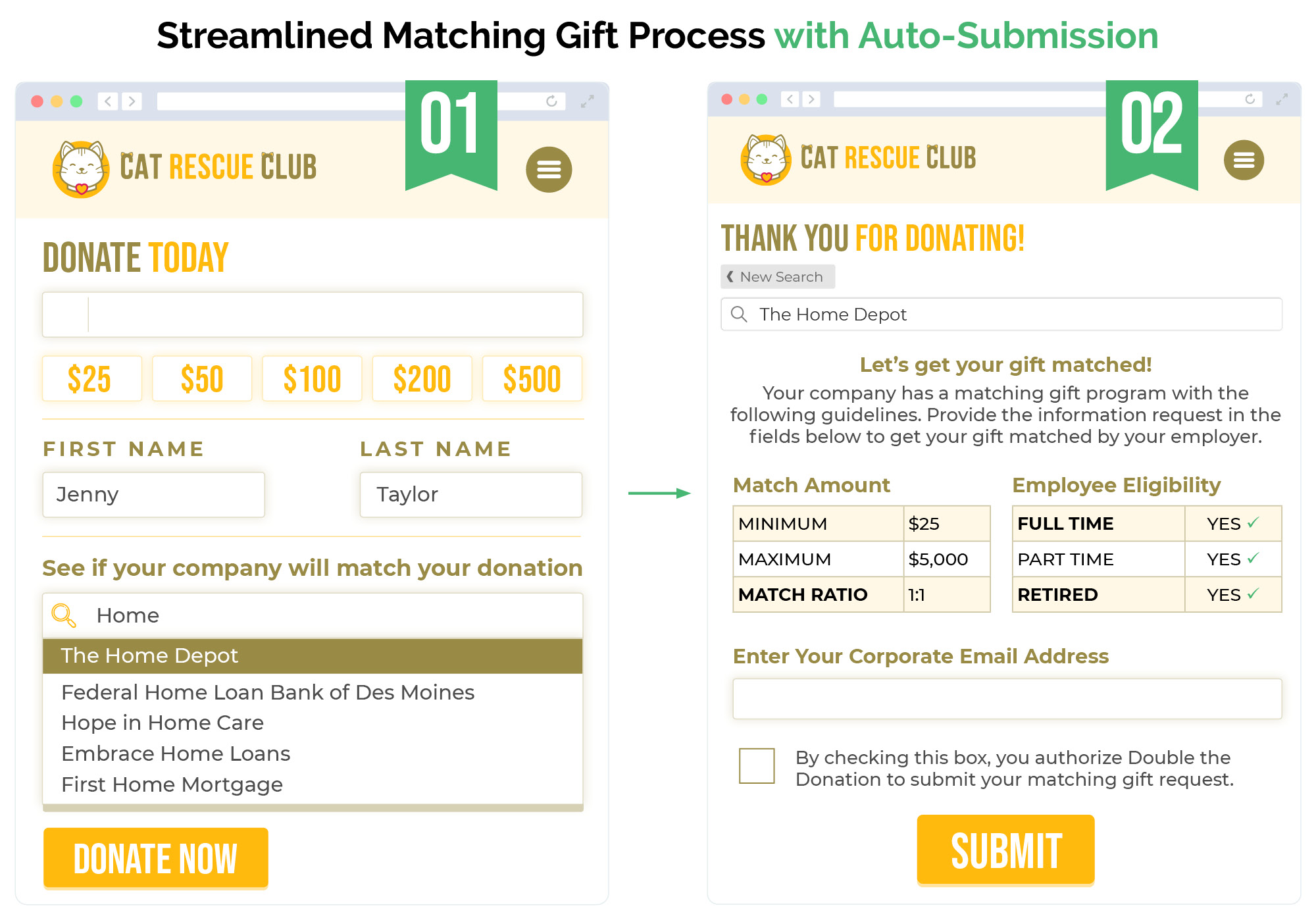

Ready to find more corporate opportunities? To maximize your results, consider using a corporate giving database like Double the Donation. Our tools allow you to identify which of your donors work for VTO-eligible companies instantly, streamlining your outreach and ensuring you never miss an opportunity to engage a corporate partner.

Start drafting your VTO letters today and transform your volunteer program. Then, increase your impact by automating your volunteer time off outreach with Double the Donation. You can even request a personalized demo to see the tools in action!