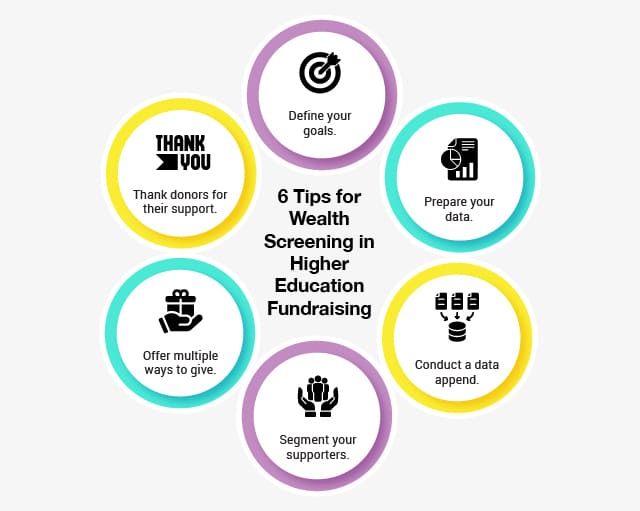

Wealth Screening in Higher Education Fundraising: 6 Tips

Donor outreach can be expensive for nonprofits and higher education institutions. Consider the process of collecting ten gifts of $100 each versus one gift of $1,000. While you’ll end up with the same amount in the end, it ultimately takes more time, energy, and funds to successfully solicit smaller gifts from ten individual donors as opposed to just one larger gift.

This scenario illustrates the power of major gifts. When your school has a dedicated approach to finding and engaging major donors, you can earn more for your cause and maximize the use of your limited resources. As a result, you’ll be better equipped to fulfill your mission and provide an enriching college experience for your students.

AlumniFinder explains that wealth screening identifies prospective donors’ capacity to give so you can target potential major donors with your outreach. Wealth screening providers assess prospects’ business affiliations, stock ownership, and home value to help organizations narrow in on the most promising prospective major donors. In this article, we’ll provide six tips so you can take full advantage of this information, pushing your wealth screening approach to the next level.

1. Define your goals.

It’s helpful to define your goals from the start to provide focus to your wealth screening and major donor fundraising efforts. When you go to your wealth screening partner with clear objectives, you can expedite the process and determine which data points to prioritize.

For instance, you may use the data from your wealth screening to:

- Identify new major gift prospects

- Retain current major donors

- Engage churned major donors

- Enhance your major donor stewardship efforts

While all of these objectives relate to major donors, their differences will impact how you collect and leverage prospect data. For example, if you’re trying to retain current major donors, you may look for any changes in stock ownership that could indicate an increase in giving capacity. On the other hand, new prospect identification may focus on finding out background information about donors’ careers and employers.

2. Prepare your data.

Before you get started with wealth screening, make sure the data you currently have about your supporters is organized and complete. When you go into your wealth screening with the most accurate, precise data possible, you’ll get better, more actionable results.

Follow these steps to prepare your data for wealth screening:

- Audit your data. Comb through your database or constituent relationship management platform (CRM). Identify any problem areas or missing information.

- Resolve inaccuracies. After you’ve reviewed your data, resolve any inaccuracies you’ve found. This step may include merging duplicate data, deleting records for deceased supporters, or removing incorrect information.

- Develop data hygiene procedures. To assist with future wealth screenings, create rules that keep your data clean and organized. For instance, you may instruct your team to enter phone numbers using parentheses like (123) 456-7890 to ensure consistent and accurate future records.

By prioritizing data hygiene, which is defined as the process of keeping your data clean and error-free, you’ll not only improve the results of your wealth screening but also make it easier for your team to effectively leverage data for additional fundraising and marketing efforts.

3. Conduct a data append.

Through your data preparation, you may notice you’re missing key information that would help you reach and engage major donors. A data append can enhance your donor records with information from third-party sources and round out your database.

The types of data you may append include:

- Demographics

- Email addresses

- Phone numbers

- Mailing addresses

Once your wealth screening is complete, your institution can use this information to reach out to prospects with donation requests through a variety of channels. For instance, you may use prospect email addresses to conduct an email marketing campaign that asks supporters to help fund a new building on campus. Alternatively, you may leverage mailing addresses to reengage lapsed major donors with a personalized direct mail campaign.

4. Segment your supporters.

Another step you can take toward streamlining the wealth screening process is segmenting your supporters ahead of time using any existing wealth or giving capacity information. This data can offer more context for your wealth screening partner and allow you to prioritize researching donors with the highest major gift potential.

You can also segment your supporters by other factors that will personalize your future outreach. For example, if some alumni are interested in funding the university’s sports teams while other supporters would rather provide scholarships to students in need, you can provide tailored donation opportunities and communications based on these preferences.

5. Offer multiple ways to give.

Once you’ve thoroughly researched your prospects, it’s time to start making donation requests. While you may be tempted to simply lead supporters to your donation page, there are so many different ways donors can contribute to your cause.

For example, Double the Donation explains that donor-advised funds (DAFs) are becoming increasingly popular, with donors contributing $52.16 billion through DAF grants last year. This fundraising method enables donors to make grants to their favorite causes over time through specialized financial accounts. DAF fundraising represents just one unique opportunity for major donors to lend their support.

Other major donor giving methods may include:

- Endowment contributions

- Planned giving

- Pledges

- Matching gifts

- In-kind donations

When you offer a variety of giving options, you increase the chances prospects will contribute. Additionally, experimenting with different donation avenues allows you to determine which are most popular amongst your supporters and focus on growing them further.

6. Thank donors for their support.

The major donor process doesn’t end when you successfully convert a prospect and receive their contribution. Use the data from your database and wealth screening to properly thank donors for their support:

- Be specific. Personalize your donor appreciation by addressing donors by name and referencing their specific donation amount. Let them know which projects or initiatives you’re using their funds for to increase accountability and demonstrate their individual impact.

- Invite them to engage in other ways. Some of your major donors may already have ties to your school or indicate that they’d like to become more involved. Invite them to engage with your organization in ways that extend beyond monetary contributions. For instance, you may recognize alumni donors with a special appreciation event or invite major donors to join your board.

- Keep their communication preferences in mind. Respect your supporters’ communication preferences and use the channels they’re most likely to respond to. For example, your wealth screening partner may find that some of your prospects are on “Do Not Call” lists. While some major donors may be touched by a phone call thanking them for their contributions, make sure to avoid making phone calls to those on “Do Not Call” lists.

Thanking your donors is a necessary step in the donor stewardship process. Showing genuine appreciation will demonstrate to your major donors that their contributions have a real impact on your institution and help you build lasting relationships with them.

Major gifts have the power to propel large projects and initiatives forward and help your students have the best college experience possible. With these tips, you can maximize the data you obtain from your wealth screening, increase your donation revenue, and give back to your campus community.